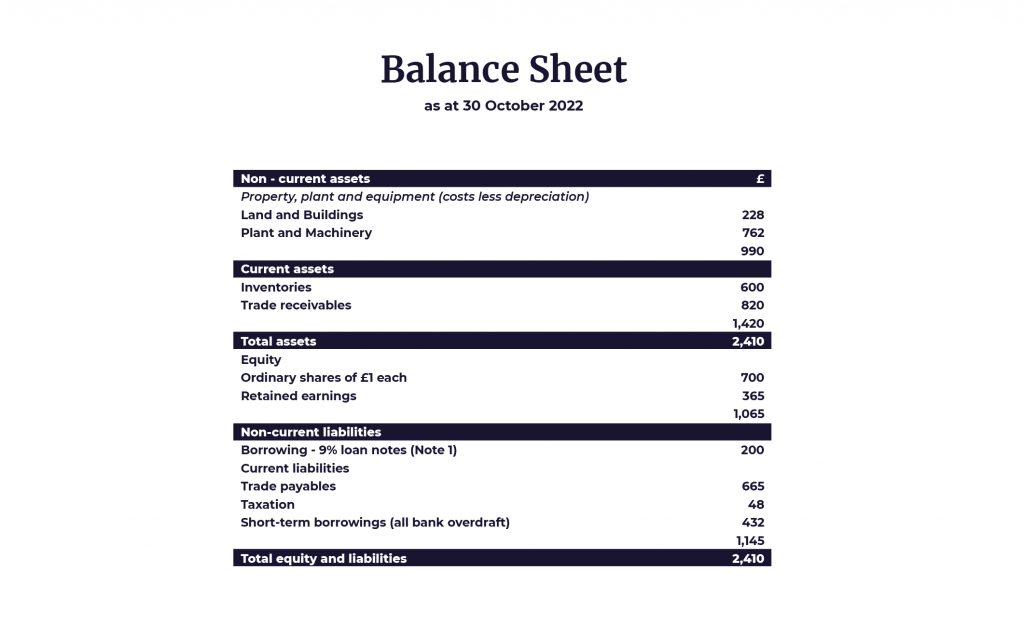

The Balance Sheet

A balance sheet is a financial document designed to communicate exactly how much a company or organisation is worth—its “book value.” It achieves this by listing and tallying all of a company’s assets, liabilities, and owners’ equity as of a particular reporting date. Typically, a balance sheet is prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy. The Purpose of a Balance Sheet Balance sheets serve two very different purposes, depending on the audience reviewing them. When a balance sheet is reviewed internally, it’s designed to give insight into whether a company is succeeding or failing. Based on this information, policies and approaches can be shifted: doubling down on successes, correcting failures, and pivoting toward new opportunities. When a balance sheet is reviewed externally, it’s designed to give insight into the resources available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest. External auditors might also use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. It’s important to remember that a balance sheet communicates information as of a specific date. By its very nature, a balance sheet is always based on past data. While investors and stakeholders may use a balance sheet to predict future performance, past performance is no guarantee of future results.

The Contents of a Balance Sheet

The information in a balance sheet is most often organised according to the accounting equation: Assets = Liabilities + Owners’ Equity. While this equation is the most common formula for balance sheets, it isn’t the only way of organising the information. Here are other equations you may encounter:

OWNERS’ EQUITY = ASSETS – LIABILITIES LIABILITIES = ASSETS – OWNERS’ EQUITY

A balance sheet should always balance. Assets must always equal liabilities plus owners’ equity. Owners’ equity must always equal assets minus liabilities. Liabilities must always equal assets minus owners’ equity. If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly. Errors are usually due to incomplete or missing data, incorrectly entered transactions, erroneous currency exchange rates or inventory levels, miscalculations of equity, or miscalculated depreciation or amortisation. Here’s a more detailed breakdown of the items that fall under the components of a balance sheet: assets, liabilities, and owners’ equity. Assets An asset is anything owned by a company that holds inherent, quantifiable value. A business could, if necessary, convert an asset into cash through a process known as liquidation. Assets are typically tallied as positives (+) in a balance sheet and broken down into two further categories: current assets and non-current assets. Current assets typically include anything a company expects it will convert into cash within a year, such as:

• Cash and cash equivalents

• Prepaid expenses

• Inventory

• Marketable securities

• Accounts receivable

Non-current assets typically include long-term investments that aren’t expected to convert into cash in the short term, such as:

• Land

• Patents

• Trademarks

• Brands

• Goodwill

• Intellectual property • Equipment used to produce goods or perform services

Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are. Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health.

Liabilities

A liability is the opposite of an asset. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet. Just as assets are categorized as current or non-current, liabilities are classified the same way. Current liabilities typically refer to any liability due to the debtor within one year, which may include:

• Payroll expenses

• Rent payments

• Utility payments

• Debt financing

• Accounts payable

• Other accrued expenses

Non-current liabilities typically refer to any long-term obligations or debts that will not be due within one year, which might include:

• Leases

• Loans

• Bonds payable

• Provisions for pensions

• Deferred tax liabilities

Liabilities may also include an obligation to provide goods or services in the future.