An income statement, also known as a profit and loss (P&L) statement, summarises the cumulative impact of revenue, gain, expense, and loss transactions for a given period. The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons over set periods.

The Purpose of an Income Statement

An income statement tells the financial story of a business’s activities. Within an income statement, you’ll find all revenue and expense accounts for a set period. Accountants create income statements using trial balances from any two points in time.

From an income statement and other financial documents, you can determine:

• Whether the business is generating a profit

• If it’s spending more than it earns

• When costs are highest and lowest

• How much it’s paying to produce its product or deliver a service

• If it has the cash to invest back into the business

Accountants, investors, and business owners regularly review income statements to understand how well a business is doing in relation to its expected performance and use that knowledge to adjust their actions. A business owner whose company misses targets might, for example, pivot strategy to improve in the next quarter. Similarly, an investor might decide to sell an investment to buy into a company that’s meeting or exceeding its goals.

The Contents of an Income Statement

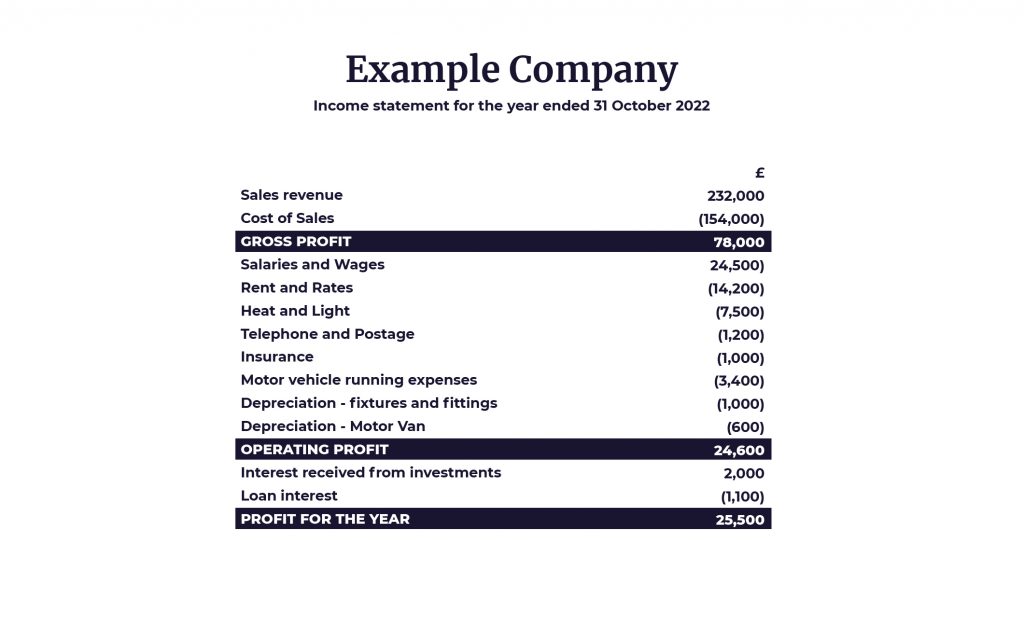

While all financial data helps paint a picture of a company’s financial health, an income statement is one of the most important documents a company’s management team and individual investors can review because it includes a detailed breakdown of income and expenses over the course of a reporting period. This includes:

• Revenue: The amount of money a business takes in during a reporting period

• Expenses: The amount of money a business spends during a reporting period

• Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever it is a business sells

• Gross profit: Total revenue less COGS

• Operating income: Gross profit less operating expenses

• Income before taxes: Operating income less nonoperating expenses Financial Skills All Managers Should Have 12

• Net income: Income before taxes less taxes

• Earnings per share (EPS): Division of net income by the total number of outstanding shares • Depreciation: The extent to which assets (for example, aging equipment) have lost value over time

• Earnings before interest, taxes, depreciation, and amortization (EBITDA): A measure of a company’s ability to generate cash flow that’s calculated by adding net profit, interest, taxes, depreciation, and amortisation together

These categories may be further divided into individual line items, depending on a company’s policy and the granularity of its income statement. For example, revenue is often split out by product line or company division, while expenses may be broken down into procurement costs, wages, rent, and interest paid on debt.

Income Statement Analysis

There are two methods commonly used to read and analyse an organisation’s financial documents: vertical analysis and horizontal analysis.

Vertical Analysis

Vertical analysis refers to the method of financial analysis where each line item is listed as a percentage of a base figure within the statement. This means line items on income statements are stated in percentages of gross sales instead of in exact amounts of money, such as pounds.

In short, it’s the process of reading down a single column of data in a financial statement and determining how individual line items relate to each other (e.g., showing the relative size of different expenses, as line items may be listed as a percentage of operating expenses). This type of analysis makes it simple to compare financial statements across periods and industries, and between companies, because you can see relative proportions. It also helps you analyse whether performance metrics are improving. Vertical analysis isn’t always as immediately useful as horizontal analysis, but it can help you determine what questions should be asked, such as: Where did costs rise or fall? What line items are contributing most to profit margins? How are they affected over time?

Horizontal Analysis

Whereas vertical analysis focuses on each line item as a percentage of a base figure within a current period, horizontal analysis compares changes in the monetary amounts in a company’s financial statements over multiple reporting periods. It’s frequently used in absolute comparisons but can be used as percentages, too. Horizontal analysis makes financial data and reporting consistent per generally accepted accounting principles (GAAP). It improves the review of a company’s consistency over time, as well as its growth compared to competitors. Because of this, horizontal analysis is important to investors and analysts. By conducting a horizontal analysis, you can tell what’s been driving an organization’s financial performance over the years and spot trends and growth patterns, line item by line item. Ultimately, horizontal analysis is used to identify trends over time— comparisons from Q1 to Q2, for example— instead of revealing how individual line items relate to others.

Income statements can be tricky. Missing off a cost or miscalculating income can really throw out your results. It’s a good idea to commission the services of a reputable accountant however, this guide should hopefully help you to understand how to read and analyse the income statement.